Technology, Liquidity & Execution

Why Trade Forex with Varianse

Our Electronic Trading Ecosystem

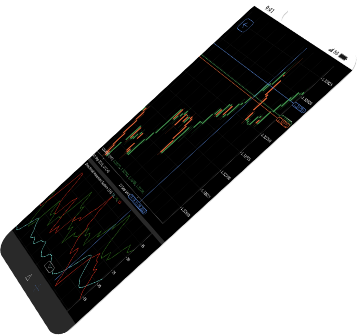

Rapid Execution Efficiency

By utilising and advanced trading infrastructure we are able to provide institutional grade trade execution, lightning fast performance in a true ECN/DMA trading environment. Learn more about the benefits of LatentX below.

Award Winning

Trade Execution

Ultra Low Latency

VARIANSE utilises direct copper and fibre optic connections to multiple tier-1 banks trading servers allowing connectivity to liquidity providers at sub-millisecond speeds, providing real low-latency trading.

Positive Order Execution

Trade with a partner on your side. All client orders are sent STP direct to multiple liquidity providers with no dealing desk intervention. Our SMART order routing and pricing engine supports complex order routing and aggregation, for superior execution during high volume trading. This ensures that our clients always receive the best price and fair and transparent order execution.

Rock Solid

Advanced Trading Technology

Technology that Powers Liquidity and Profits

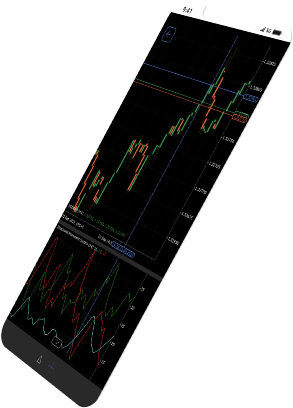

Equinix Trading Servers

Our trading servers are located in the low latency suite of the Equinix data centre in London, an exclusive data centre populated by many of the world’s largest banks.

VARIANSE have direct connectivity to a global marketplace of electronic trading and financial technology service providers that gives us the ability to connect and adapt to the forefront of electronic markets like no other.

The Prime Trading Advantage

Liquidity

Prime Liquidity

We Work with You Not Against You

We aim to provide our clients with a trading service which meets their requirements and fully services their needs based on their trading style and strategy.

Your global trading connection

We are an award-winning, internationally regulated, trusted and secure broker.

CFDs are complex instruments and come with a high risk of losing money

rapidly due to leverage. 58% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.